contra costa county sales tax rate 2019

City of Capitola is 900. Prime TRA CityRegion Cities 01000 Antioch 02000 Concord 03000 El Cerrito 04000 Hercules.

Understanding California S Sales Tax

SEPTEMBER 2019 COUNTY OF CONTRA COSTA DETAIL OF TAX RATES 2019-2020 ROBERT CAMPBELL COUNTY AUDITOR-CONTROLLER MARTINEZ CALIFORNIA.

. The December 2020 total local sales tax rate was 8750. What is the sales tax rate in Contra Costa County. 2 Rate includes 05 Mass Transit System MTS in Eagle and Pitkin Counties and 075 in Summit County.

3 Cap of 200 per month on service fee. 4 beds 3 baths 2337 sq. House located at 735 Winslow St Crockett CA 94525 sold for 890000 on May 11 2022.

The Contra Costa County sales tax rate is. 1 Reduced collection of sales tax from certain businesses in the area subject to a Public Improvement Fee. Heres how Contra Costa Countys maximum sales tax rate of 1075 compares.

399 006 236th of 3143 071 001 1753rd of 3143 Note. If you need specific tax information or property records about a property in Contra Costa County contact the Contra Costa County Tax Assessors Office. County Rates with Effective Dates as of July 1 2020.

The minimum combined 2022 sales tax rate for Contra Costa County California is. The current total local sales tax rate in Concord CA is 9750. County Rates with Effective Dates as of April 1 2015.

The Unincorporated areas are 900. On a quiet cul de sac in the charming town of Crockett sit. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

Business Recovery Grant Program Phase 2 of the Business Recovery Grant program is now open. From 875 to 925. Apply now through June 1 2022.

Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. Contra Costa County sales tax.

Next to city indicates incorporated city City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings Avery 7250 Calaveras Avila Beach 7250 San Luis Obispo Azusa 9500 Los Angeles. City of Santa Cruz is 925. The District of Columbias sales tax rate increased to 6 percent from 575 percent.

Sales Tax Breakdown Concord Details Concord CA is in Contra Costa County. From 725 to 825. Historical County Sales and Use Tax Rates.

City sales and use tax rate changes. 3 beds 2 baths 1614 sq. Many businesses that did not qualify in Phase 1 are now eligible to apply in Phase 2.

From 725 to 775. District 201920 Tax Rate Maturity Acalanes Union 1997 00118 2023-24 Acalanes Union 2002 00208 2024-25. Concord is in the following zip codes.

Angels Camp Calaveras County. This page provides general information about property taxes in Contra Costa County. Enjoy this beautiful Lakefront private setting.

Sales Use Tax Rates Effective 7-1-2020. BridgeMLS Bay East AOR or Contra Costa AOR Sold. 4 Sales tax on food liquor for immediate.

A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net services early childhood services and protection of vulnerable populations thereby increasing the total sales tax rate in Contra Costa. House located at 12 N Lake Dr Antioch CA 94509 sold for 625000 on May 9 2022. County Rates with Effective Dates as of October 1 2016.

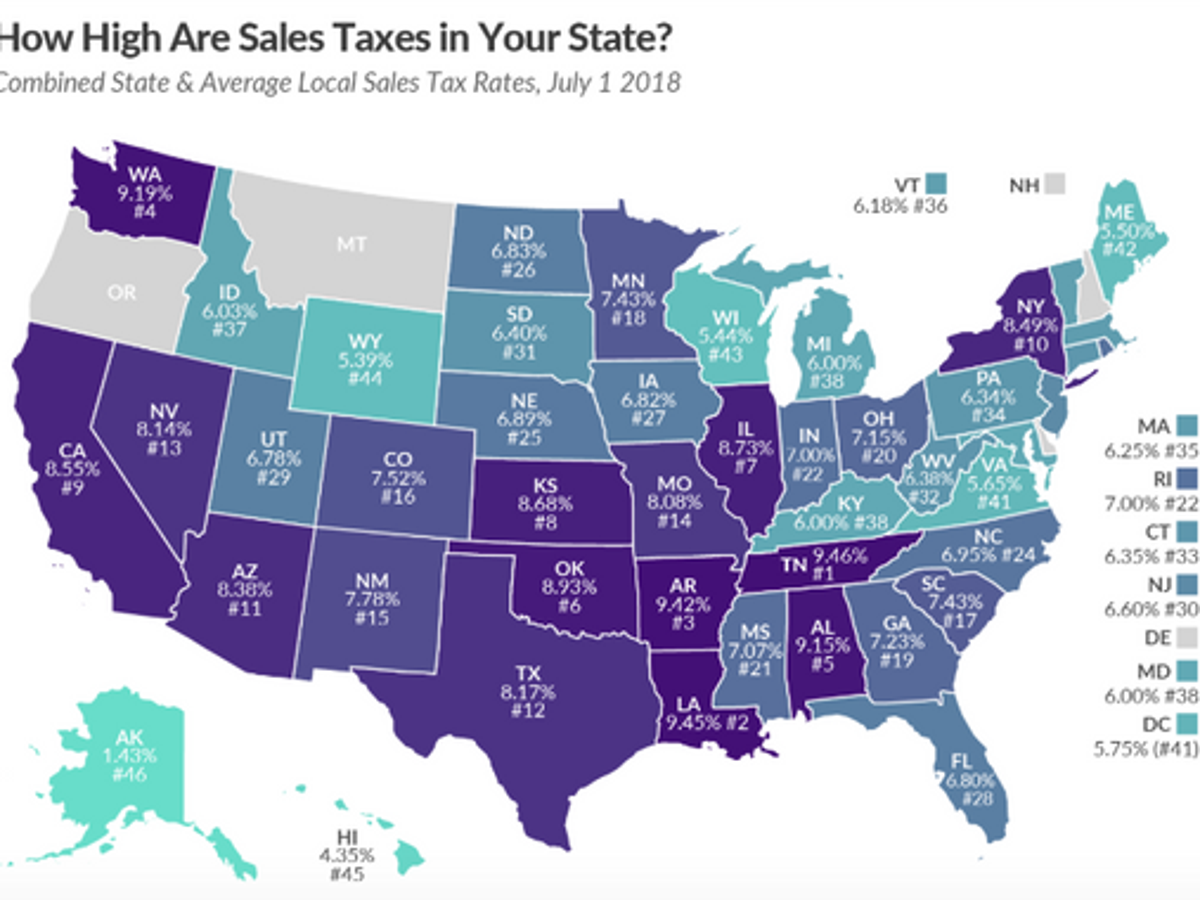

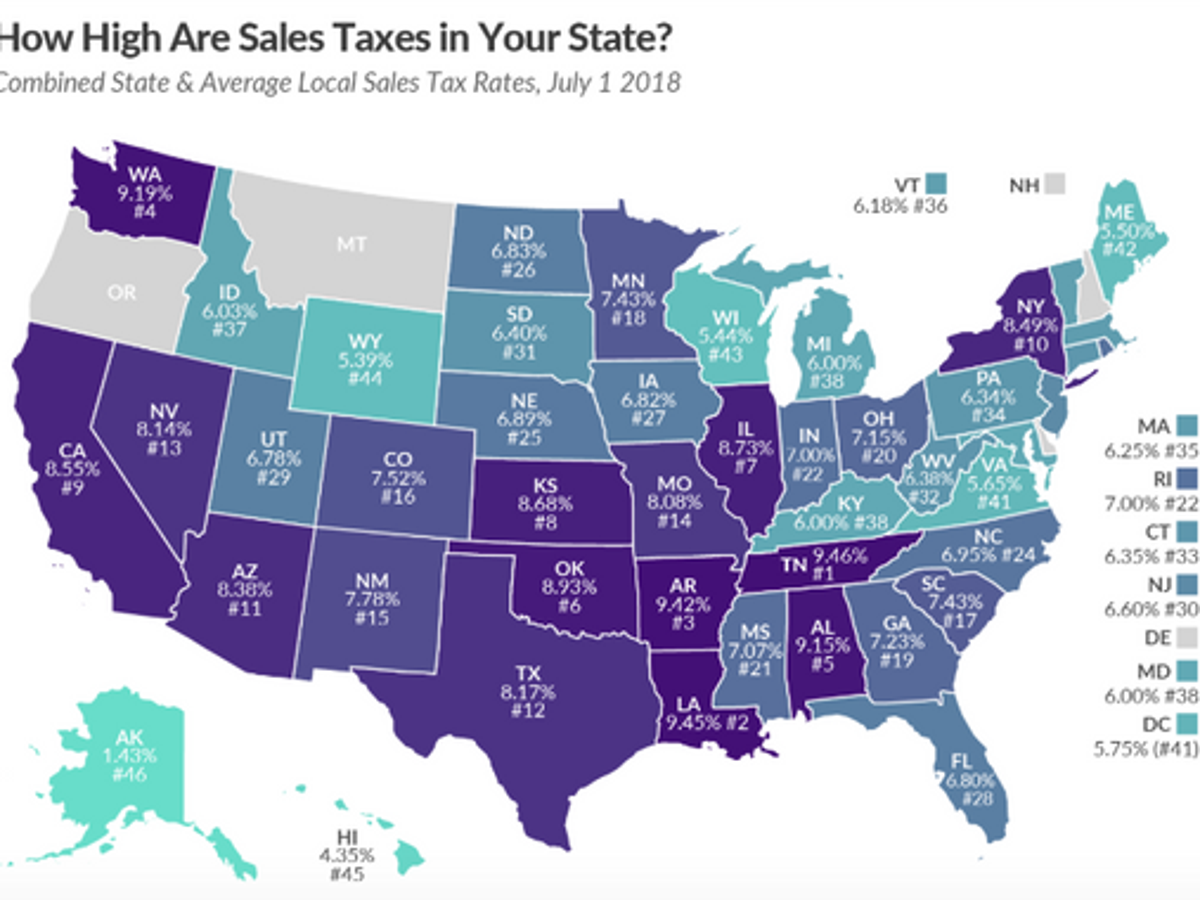

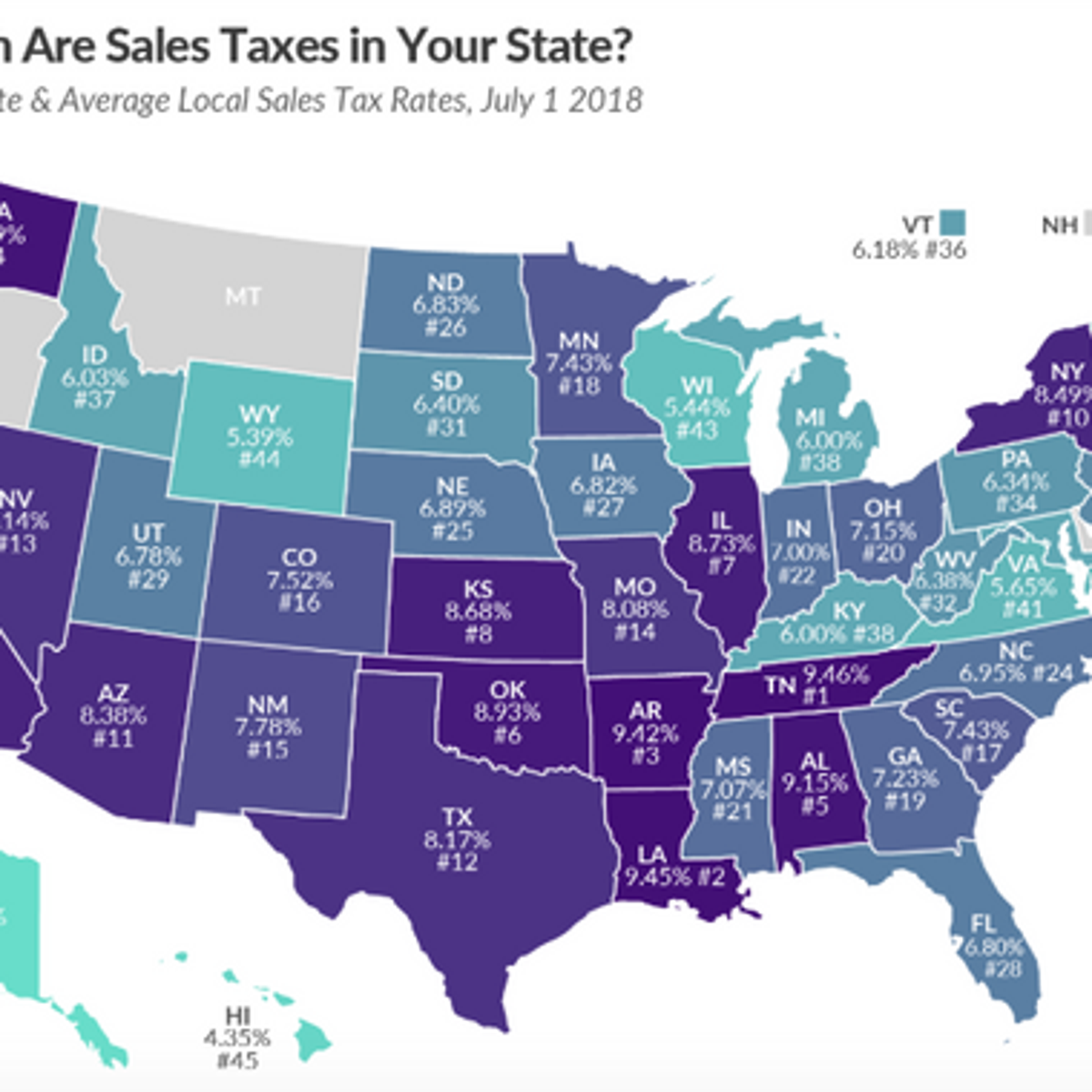

The average sales tax rate in California is 8551 The Sales tax rates may differ depending on the type of purchase. City of Scotts Valley is 975. 94518 94519 94520.

This is the total of state and county sales tax rates. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. Three cities follow with combined rates of 10 percent or higher.

BridgeMLS Bay East AOR or Contra Costa AOR Sold. City of Watsonville is 925. Sales and Use Tax Rates Effective April 1 2019 NCDOR.

California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 2 P a g e Note. Sales tax rate differentials can induce consumers to shop across borders or buy products online. Antioch Contra Costa County.

Many local sales and use tax rate changes take effect on April 1 2019 in California as befits its size. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent. The California state sales tax rate is currently.

Contra Costa County in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Contra Costa County totaling 075. The Contra Costa County Sales Tax is 025. 3 rows The current total local sales tax rate in Contra Costa County CA is 8750.

Footnotes for County and Special District Tax. County Rates with Effective Dates as of October 1 2018. County Rates with Effective Dates as of April 1 2019.

Contra Costa Water Land Levy 00028 - East Bay Regional Park 00021 2033-34 John Swett 2002 00234 2025-26. Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. From 925 to 975.

The 2018 United States Supreme Court decision in South Dakota v. Usually it includes rentals lodging consumer purchases sales etc For more information please have a look at. DETAIL OF TAX RATES 2018-2019 ROBERT CAMPBELL COUNTY AUDITOR-CONTROLLER MARTINEZ CALIFORNIA.

California state sales tax. Prime TRA CityRegion Cities 01000 Antioch 02000 Concord.

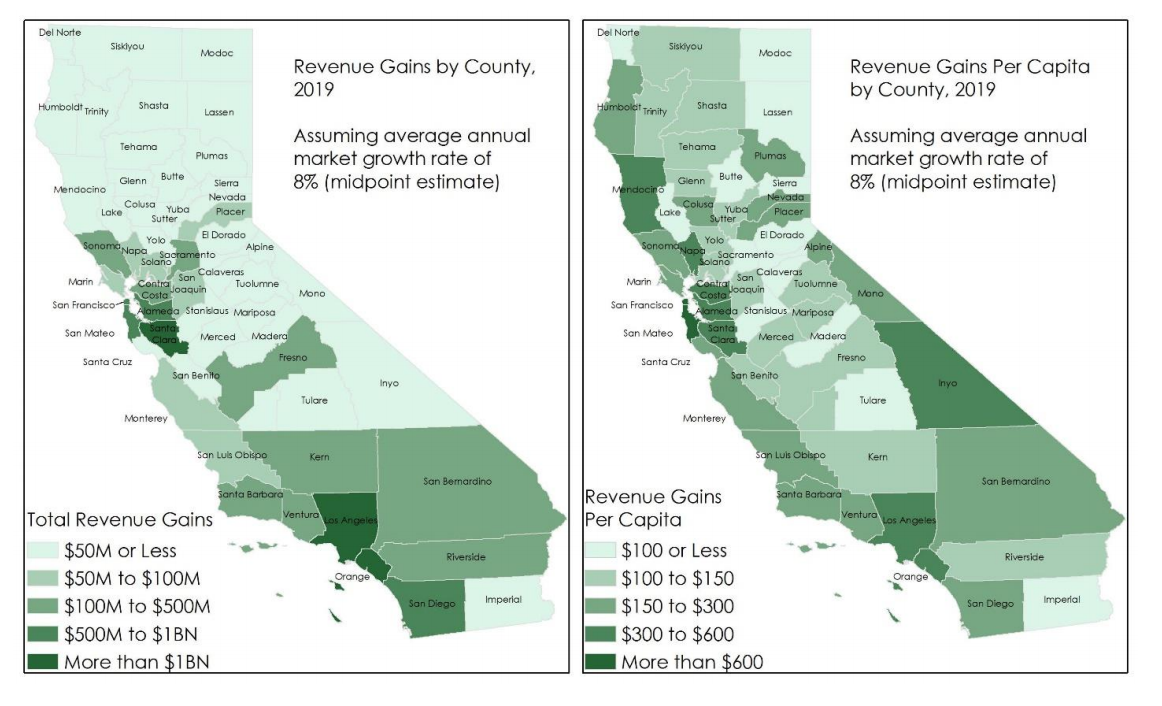

How Tax Collections From Online Sales Rose Ucla Anderson Review

How Tax Collections From Online Sales Rose Ucla Anderson Review

Understanding Where California S Marijuana Tax Money Goes

Restricted Stock Units Jane Financial

Understanding California S Sales Tax

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Sales Taxes How Much What Are They For And Who Raised Them

Why Would A County Increase Your Property Taxes Based On How Much Concrete You Have Driveways Mow Strip Borders Etc Quora

Sales Taxes How Much What Are They For And Who Raised Them

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

California City County Sales Use Tax Rates

Understanding California S Sales Tax

File Sales Tax By County Webp Wikimedia Commons

California Sales Tax Rates By City County 2022

California Sales Tax Rate Changes April 2019

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Understanding California S Sales Tax